Introduction:

YourMoneyMatters Guide to Understanding Price vs. Value in Finance Topic that’s often overlooked but crucial in the world of investments: difference between Price and Value in finance. Just like how a single rose can hold more value than an expensive dress on Valentine’s Day, the concepts of price and value play a significant role in our financial decisions.

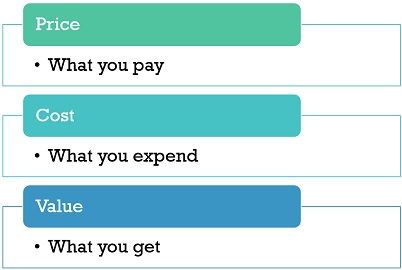

Price vs. Value: Decoding the Basics

Price:- It’s the amount of money you shell out to purchase something.

Value:- This refers to the worth or importance that something holds for you.

An Everyday Example

Imagine buying salt for a mere Rs.10 per kilogram. Even if the price were to skyrocket to Rs.100 or Rs.400 per kilogram, you’d probably still buy it, right? That’s because the value of salt, in terms of its necessity and utility, remains high regardless of the price tag.

Personal Anecdote

Recently, purchased a second-hand Nokia 6610 for just Rs.800, a steal considering its actual value of Rs.8,500. This simple purchase highlighted the essence of getting more value than what you pay for, making it a smart investment at end.

The Cheapness Factor

In finance lingo, ‘cheapness’ is defined by the value a product provides relative to the price you pay for it. It’s all about getting the most bang for your buck!

Spotting High-Value, Low-Price Gems

Let’s take a look at some real-life financial products that embody the Price vs. Value paradigm:

Term Insurance: Despite offering substantial coverage, term insurance often comes at a surprisingly low cost, making it a high-value investment.

Endowment Policies: On the flip side, endowment policies, with their hefty price tags and minimal returns, often fall short in delivering value to investors. This is difference between Price and Value in finance

Navigating the Financial Jungle

In the vast world of financial products, distinguishing between cheap and expensive offerings is key. Whether you’re eyeing stocks, mutual funds, or real estate, always weigh the price against the value it brings to the table.

Stock Market Insights

Successful investors swear by buying stocks that are undervalued in the market. This strategy pays off in the long run, as demonstrated by the fluctuating prices of stocks like Reliance, ICICI Bank, and others.

Parting Thoughts

As you navigate the intricate web of finance, remember to assess the value proposition of every investment opportunity. By understanding the interplay between price and value, you can make informed decisions that align with your financial goals.

So, what’s your take on the Price vs. Value debate in finance? Share your thoughts and experiences in the comments below!

Statutory Warning: This blog is for information purposes only. Readers are advised to conduct their own research before making any financial decisions.

—