Introduction:

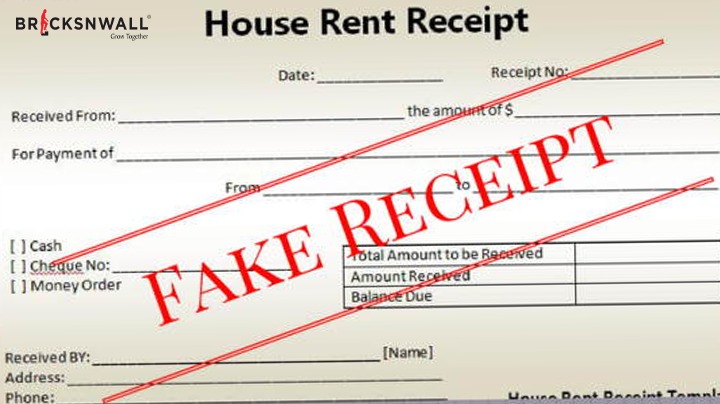

Friends have you ever considered bending the rules a bit to claim a higher House Rent Allowance (HRA) by submitting fake rent receipts? Well, before you dive into that murky territory, let’s chat about the recent developments in the finance world that might just make you think twice before taking that risk. Let’s know, The Truth About Claiming HRA with Fake Rent Receipts

The HRA Conundrum:

So, for those unfamiliar with the concept, HRA (House Rent Allowance) is a component of your salary that your employer pays if you reside in a rented property. It’s a nifty way to reduce your annual tax liability by claiming exemptions on the rent you pay.

The Temptation of Fake Receipts:

Now, here’s where things get dicey. Many individuals have been tempted to inflate their HRA claims by submitting fake rent receipts. It’s like a shortcut to tax benefits, right? But hold your horses because the Income Tax Department is cracking down on these deceptive practices.

The Crackdown Begins:

The IT department is no longer turning a blind eye to these fraudulent activities. They are now demanding additional documentation to verify the authenticity of HRA claims. So, if you’ve been fudging those rent receipts, it might be time to rethink your strategy.

Documents on Demand:

Curious about what documents the IT department might ask for during a verification process? Let’s break it down for you:

– Rent receipts or rental agreement

– Landlord’s ID proof

– Form 12BB for HRA exemption

– Additional supporting documents as deemed necessary

The Risk of Getting Caught:

Submitting fake rent receipts is akin to playing with fire. With the IT department ramping up their scrutiny, the chances of getting caught in the act are higher than ever. From cross-checking addresses to verifying ownership details, they are leaving no stone unturned in their investigations.

The Perils of Deception:

Imagine the hassle of having to fabricate an entire web of lies just to save a few bucks in taxes. It’s not just ethically questionable but also legally risky. The repercussions of getting caught could far outweigh any benefits gained from these deceitful practices.

Your Take on the Matter:

Have you or someone you know ever toyed with the idea of using fake rent receipts to claim HRA? What are your thoughts on this contentious issue? Share your insights and experiences in the comments below.

Conclusion:

In a world where financial transparency is non-negotiable, taking shortcuts like submitting fake rent receipts for HRA claims is a risky gamble. So, before you tread down that path, weigh the potential consequences against the fleeting gains. Remember, honesty is the best policy, especially when it comes to your finances.

Statutory Warning: This blog is for information purposes only and should not be considered as financial advice. Readers are advised to conduct their own research before making any financial decisions.